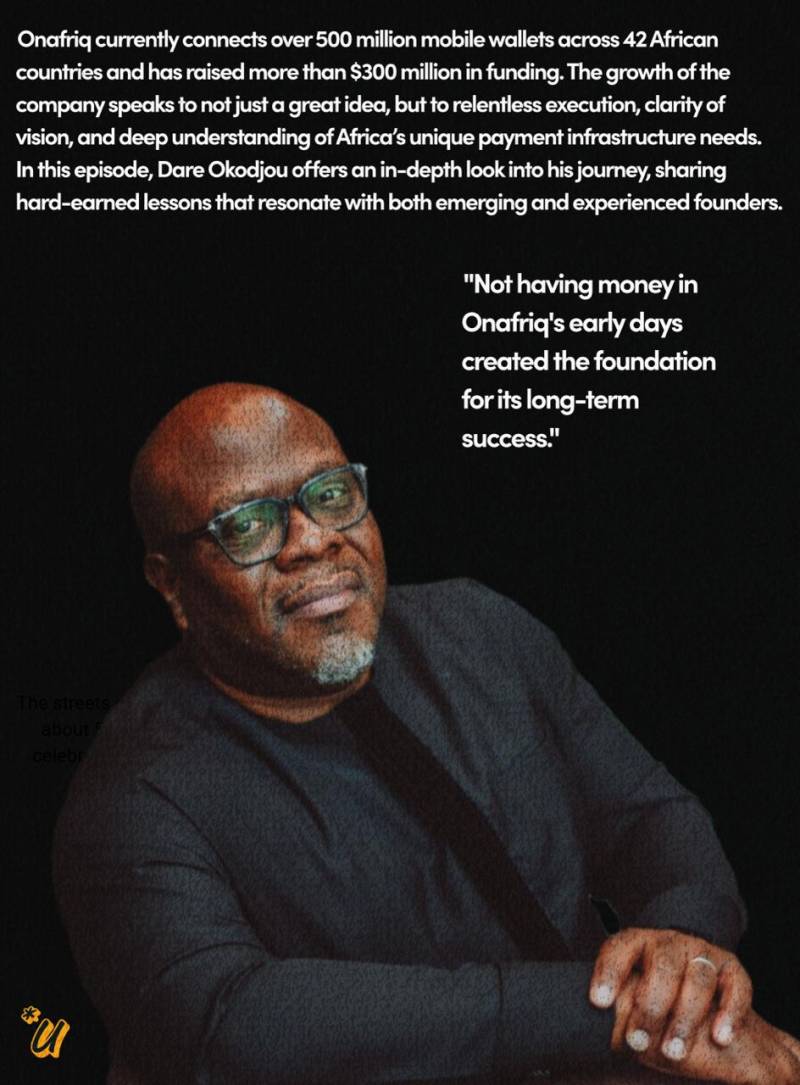

Dare Okoudjou's entrepreneurial story continues to inspire Africa’s tech and startup community. After a successful career at MTN Group, where he worked on pioneering mobile money initiatives, Dare made the bold decision in 2009 to step away from corporate comfort and pursue a vision that would transform the digital payments landscape across Africa. That vision became Onafriq—formerly known as MFS Africa—now Africa’s largest digital payments network.

Related article - Uphorial Sweatshirt

Onafriq currently connects over 500 million mobile wallets across 42 African countries and has raised more than $300 million in funding. The growth of the company speaks to not just a great idea, but to relentless execution, clarity of vision, and deep understanding of Africa’s unique payment infrastructure needs. In this episode, Dare Okodjou offers an in-depth look into his journey, sharing hard-earned lessons that resonate with both emerging and experienced founders. His transition from MTN to Onafriq wasn’t without hurdles. He recounts the complex issues surrounding work permits and the difficulties of securing initial funding—pain points many African founders know too well. These early challenges were defining moments that tested his commitment to solving a problem he knew was both massive and underserved: the inefficiency of cross-border payments on the continent.

Dare emphasizes the importance of building a strong and culturally aligned team. Recruiting people who believed in the long-term vision of Onafriq was just as crucial as solving technical or regulatory hurdles. This human-centered focus became a key pillar of the company’s success as it scaled across multiple countries and regulatory landscapes. The diversity within the Onafriq team played a critical role in how the company adapted and grew in various markets. The company’s recent rebrand from MFS Africa to Onafriq was not just cosmetic—it marked a strategic evolution. The rebranding reflected the pan-African and global ambitions of the business, aligning the identity more closely with the company’s mission of making financial services accessible and interoperable across Africa and beyond. With increasing attention from global investors and partners, this new chapter symbolizes a maturity that now goes beyond infrastructure to impact.

Dare also shares his thoughts on the future of digital payments and the broader fintech ecosystem in Africa. He highlights stablecoins as an area to watch, pointing to their potential for more secure and transparent transactions. His insights reveal a founder who not only understands the present but is actively anticipating the next wave of innovation. What sets Dare apart isn’t just the scale of his achievements but his grounded perspective on leadership. He talks candidly about stress management, staying focused in a rapidly evolving industry, and the intentional effort it takes to balance personal life with the high demands of building a fintech empire. These reflections are particularly valuable for founders who often struggle to maintain equilibrium while pursuing growth.

For anyone building in Africa—especially in fintech—Dare Okodjou’s story offers clarity, encouragement, and a reminder that with persistence, vision, and the right team, it's possible to reshape entire industries. Onafriq’s trajectory is proof that African-born solutions can achieve global relevance, and that founders on the continent are not just competing—they’re leading. Dare’s journey from a secure position at MTN to launching and scaling Onafriq is a masterclass in bold decision-making, resilience, and visionary leadership. His experience provides a real-world blueprint for building not only a successful company but a legacy of innovation in Africa’s tech ecosystem.