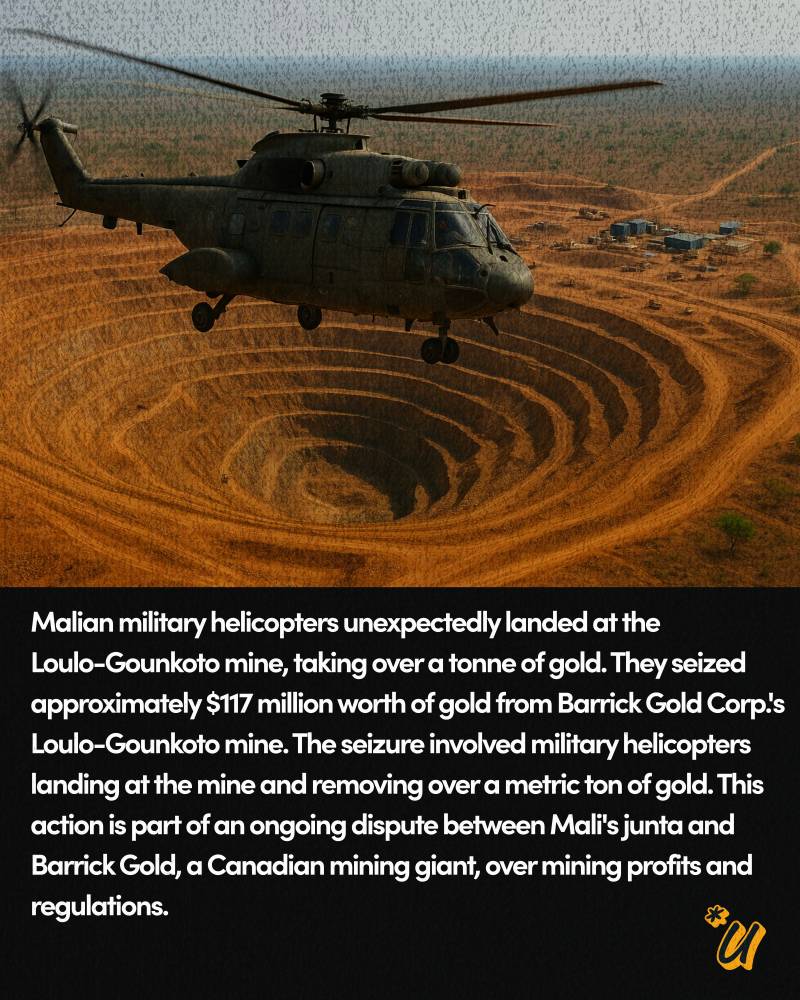

In a dramatic turn, Mali’s military-led government deployed a military helicopter to the Barrick-owned Loulo‑Gounkoto gold complex, airlifting over one metric ton of gold—worth approximately $107M to $117M based on prevailing prices—to finance the site’s resumed operations. The bullion had sat in the mine’s storeroom since January, when authorities seized three other tonnes earlier. The incident is much more than a glittering heist; it's emblematic of a shift in African resource governance. Mali, along with other Sahel states, is pursuing an aggressive policy of resource nationalism, revising tax codes, increasing state shares in mines, and asserting economic sovereignty over strategic assets.

At the centre of this upheaval is Barrick, once the backbone of Mali’s gold industry. Loulo‑Gounkoto accounted for roughly 15% of Barrick’s output in 2023, employing about 8,000 people, 97% of them local. Yet tensions boiled over after the junta detained several Malian staff and issued export restrictions earlier this year. Barrick halted operations in January amid accusations of unpaid taxes and refusal to adopt the 2023 mining code, demanding higher royalties and up to 35% government ownership.

Read Also: Uphorial Sweatshirt

The gold seized in this latest helicopter mission was transported to the state-owned Banque Malienne de Solidarité in Bamako under a court-appointed interim administrator, former health minister Soumana Makadji, who has said sales of the bullion would fund the mine's restart. Meanwhile, milling operations officially resumed, with the first new gold bars expected within roughly 11 to 13 days. Still unresolved is whether Mali’s intervention is legitimate. Barrick maintains ownership of the mine and is pursuing arbitration at the World Bank’s ICSID, protesting what it calls illegitimate and ill-advised actions that threaten the complex’s long-term viability. This episode unearths deeper dynamics. It reveals how post‑colonial shifts, military rule, and economic pressures are colliding on Mali’s goldfields. For years, Western mining firms such as Barrick, Resolute, and B2Gold operated under fiscal frameworks they helped shape. Now, military juntas are rewriting the rules—demanding renegotiations, punitive taxes, and tighter control over foreign investments.

Beyond the headlines, this standoff raises profound questions about sovereignty and sovereignty’s limits. Is Mali reclaiming its resources after years of extraction, or is it endangering investor confidence with aggressive tactics? Barrick’s CEO Mark Bristow has called for dialogue, warning that the suspension of operations could cut earnings by 11% in 2025—a costly outcome for both the company and Mali’s economy. Yet this struggle isn’t one-sided. Mali’s military government argues that gold is central to national survival: it accounts for around 80% of the country’s exports. With plunging gold production—down 23% in 2024—authorities say stronger oversight and revenue reclamation are vital.

As he looms over these developments, former administrator Makadji stands as a symbol of Mali’s fight for economic agency. His mission: turn gold—once trapped in vaults—into working capital for the country. But the outcome is precarious. If arbitration undermines Mali’s actions, it could deter future investment across the region. This isn’t just corporate drama—it’s a geopolitical pivot. With Western firms retreating or recalibrating, Mali and neighbors may be opening the door for Russian or other non‑Western players, as hinted by Sahel observers and sources in Mali’s evolving economic landscape. In capturing $117M in gold via helicopter, Mali has broadcast a bold message: resource sovereignty is non-negotiable. But the nation's challenge now lies in balancing that assertion with rule‑based stability, so that gold does indeed shine for Malians, without scaring off the expertise or capital needed to make that promise a reality.